The Madness of Money in March

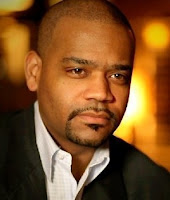

Consortium grad Rob Wilson There's March Madness, and then there's Rob Wilson's March Money Madness . Once again Consortium graduate Wilson will stage his contest that runs parallel to the college-basketball national tournament. This year, the prizes are bigger. In its third year, his contest helps promotes awareness in investing and stock selections. Just like the NCAA tournament, there are brackets and rounds of competition. Participants will not project basketball winners; they must predict investment performance by choosing the stocks of companies they expect will generate the highest return during the month of March. From week to week, just as March Madness brackets are about choosing a winner between two teams in a 64-team tournament, Money Madness also embraces "bracketology." Participants decide which of two stocks will out-perform the other. As with NCAA brackets, participants try to project the winner of several pairs of stocks in several industries.